Circle CEO praises Avocado Multisig wallet despite collateral dropping

Circle’s CEO praised Avocado Multisig, a multi-chain wallet, calling it a USDC “gas tank.”

Circle CEO Jeremy Allaire lauded the launch, highlighting the wallet’s unified USDC “gas tank,” allowing all signers to pool resources to cover transaction fees across supported blockchain networks. This feature simplifies the often complex issue of gas fee management in the defi ecosystem.

The announcement came on Aug. 29. The protocol launched its Avocado defi wallet in March. The new wallet can cater to many users, including individuals, teams, and institutions.

Multi-signature wallets, commonly known as multisig, require multiple private keys to access crypto assets or execute transactions. This feature enhances security by eliminating the risk of a single point of failure, a point underscored by defi researcher with a Twitter motti DefiIgnas.

One of the Features of Avocado Multisig is its ability to streamline treasury management. The wallet consolidates treasuries into a single address across multiple networks, enabling new use cases like token bridging.

Unlike standard multisig wallets that necessitate a new address for each blockchain, Avocado Multisig uses a single address across more than ten different networks.

The wallet also introduces Account Abstraction, which brings Ethereum (ETH) smart contract functionality directly into the wallet interface, further enhancing its utility and interoperability.

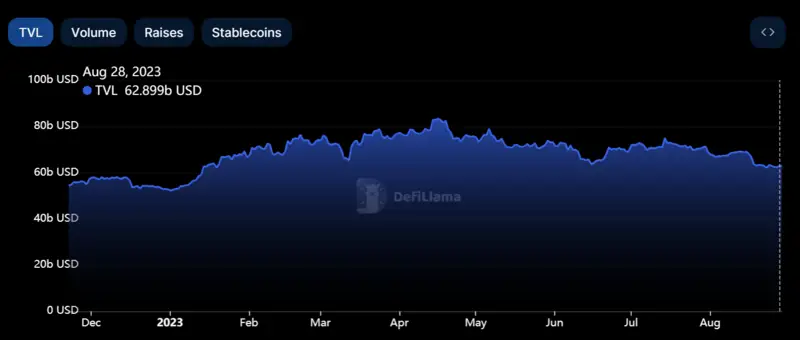

Despite its innovative offerings, Instadapp has faced challenges. The protocol currently has $1.95 billion in total value locked (TVL), ranking it 13th in the defi space. However, its collateral has plummeted 85% from its peak of $13.5 billion in September 2021, according to data from DeFiLlama.

Additionally, its governance token, INST, has also seen a significant decline, trading at $1.10 at the time of writing, a far cry from its peak of $24.40.

Avocado Multisig’s launch is crucial for Instadapp as it seeks to regain momentum and solidify its position in the rapidly evolving defi landscape.

Comments

Post a Comment