Terra (LUNA) Price Drops As Investors Decry Potential Risks Associated With DeFi Platforms: Is The $1.46 Support Floor Final?

Terra (LUNA) price has been moving horizontally for months, as the token’s value remained within the firm grip of a supplier congestion zone. Upwards, the price was facing rejection due to the major resistance at $3.49. Downwards, the price sat on the major support at $1.46.

This has been the case for LUNA price since mid-September, right after the network’s token-burning process to reduce the extra supply. The move helped increase its value by provoking increased demand.

However, the token started plummeting in value shortly after, around the time when Korean MPs were scrutinizing LUNA during legal proceedings.

Korean MPs scrutinize LUNA amidst legal proceedings – https://t.co/5zRyPgmVb9

Over the last couple of years, the blockchain industry has grown several times. While there has been a huge number of cryptocurrency projects that were introduced into the industry, none has cau… pic.twitter.com/PwyRLQqKdu

— CryptoSavedMe (@CryptoSavedMe_) October 1, 2022

A month later, the situation worsened for LUNA token and the entire cryptocurrency industry when giant crypto exchange FTX crumbled, citing liquidity crises. Consequently, LUNA continued trading horizontally and spent the second half of December below the major support. Bulls pulled it back up on January 9, marking a bull trap that was authenticated on January 23 as prices started dipping again.

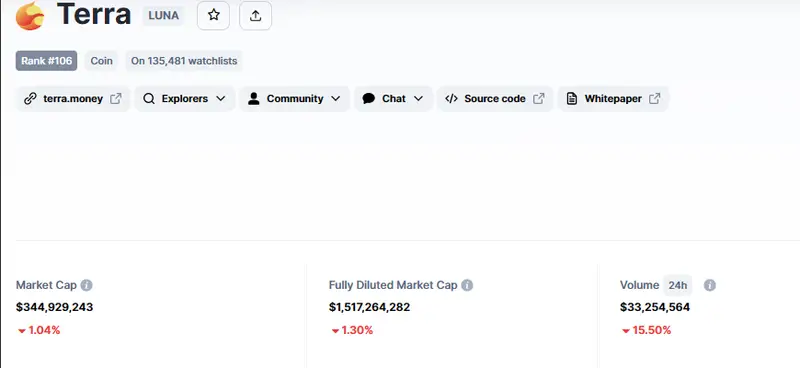

At the time of writing, LUNA was trading at $1.5 after shedding 1.34% on the last day. Accordingly, its market cap was also down 1.08%, with indications of investors fleeing the LUNA market for the short term.

As indicated in the figure above, LUNA was recording a 24-hour trading volume of $33.25 million. This was a 15.5% drop in 24 hours. Nevertheless, LUNA remains a trending subject on Crypto Twitter as traders and investors observe to see whether it will outperform LUNC.

$LUNC vs $LUNA 🚀🌕

Who will pump first? 🤔

–#Lunc #LuncBurn #LUNCcommunity #LuncArmy #LUNCpenguins #Crypto #USTC #Binance #Terra #News #Burnalot #BetterLunc #Terraport pic.twitter.com/5Wrwbpbjzi— 🔥BetterLunc🚀🌕 (@BetterLunc) February 25, 2023

Terra (LUNA) Crypto Price Plummets After Unknown Wallet Dumps Tokens Worth $1 Billion

After a period of value surge for Terra (LUNA), the token witnessed a major plunge that saw the token lose almost 40% in value beginning February 23. The sudden crash was a consequence of a massive sell-off of LUNA tokens by an unknown wallet, amounting to around $1 billion.

reddit 🤖: Terra (LUNA) Crypto Crashes as Wallet Dumped $1 Billion https://t.co/6PvsnSMHx8

— storewire (@storew1re) February 28, 2023

The sell-off has escalated into a concerning issue among LUNA community members, reinvigorating fear about the safety and stability of decentralized finance (DeFi) platforms. The incident impacted Terra’s ecosystem significantly, weakening the value of the LUNA token further. Moreover, it has underscored the need for more transparency and regulation within the crypto market.

Speaking on the matter, the Head of Research at The Block, Igor Igamberdiev, said that the concerned wallet had accumulated a sizable quantity of LUNA tokens since mid-2020. Igor also noted that the holdings had steadily increased over the past months before dumping the entire basket of LUNA holdings. This caused a stark decline in LUNA price.

Given the unknown identity of the wallet owner, speculation has it that it belongs to a deep-pocketed institutional investor(s). Furthermore, the timing of the incident was also suspicious, coinciding with a broader market downtrend and a surge in trading volume.

Resultantly, the Terra (LUNA) market has since been populated with concerned investors, all decrying the potential risks associated with DeFi platforms. Notably, based on the decentralized nature characteristic of DeFi platforms, they are not subject to the regulatory oversight applied in traditional financial institutions. As such, investors feel susceptible to market manipulation and fraud.

Will LUNA Price Go Below The Major Support?

LUNA price has been trapped within a fixed supplier congestion zone after a rejection from the $3.49 level on September 16. This roadblock has kept LUNA price stunted for almost five months now. The price was sitting on the major support at $1.46. Notably, this level has been a pillar for LUNA price since May, when the Terra ecosystem collapsed.

An increase in buying pressure from the current level could free LUNA price from the formidable supplier congestion zone. This would mean a 136.84% ascent from the current level to surpass the $3.49 barrier.

Before then, however, LUNA price was confronting immediate resistance due to the 50-day Exponential Moving Average (EMA) at $1.7898. If bulls manage to flip this barrier into support, they could use it to fight off the resistance presented by the 100-day EMA at $2.097. Beyond that, only the resistance at $3.1 would remain before bulls can attempt to breach the major roadblock.

LUNA/USDT Daily Chart

On the downside, if investors’ fear continues fueling the selling pressure, LUNA price could skid below the major support. Such a move would mimic the December 16 downtrend, where investors endured three weeks below the $1.46 support floor. If this narrative plays out, LUNA price could resume its uptrend around April.

The relative strength index (RSI) also failed to inspire hope among investors as it was moving below the middle line. The price strength at 31 was also concerning, and the Stochastic RSI at 39 showed that the path with the least resistance was downward.

The moving average convergence divergence (MACD) was also in the negative territory below the zero line. This, coupled with the histograms flashing red, showed that bears were leading the market.

EMAs Crucial For LUNA Price

It is worth mentioning that movements of the EMAs were critical for LUNA price. If investors use them correctly, they could be significant indicators of what the future holds for LUNA. Note that the EMAs are most suited for trending markets to determine an asset’s trading bias.

In this case, the 50-day and 100-day EMAs have been following LUNA’s strong and sustained downtrend. Traders should therefore pay attention to both the direction of the EMA lines and the relation of the rate of change from one bar to the next.

LUNA Alternatives

While the investors and traders continue monitoring the EMAs for LUNA price, consider FGHT, the native token of the move-to-earn (M2E) ecosystem Fight Out. The token is in the presale stage, with more than $5.11 million raised thus far. Buy the FGHT token before the presale ends on March 31.

$5.1M RAISED! 💪

We are moving QUICK, make sure to get in on the presale now, so you don't miss out 👀

Hurry and claim your #Presale BONUS today! 🔥https://t.co/9pikKGRjSd#Presale #Web3 #Competition pic.twitter.com/DO1N8bXTOx

— Fight Out (@FightOut_) March 5, 2023

Fight Out is revolutionizing the gaming industry with blockchain technology and the power of play-to-earn. Industry analysts are very bullish about FGHT in 2023 and beyond due to its strong fundamentals.

Read More:

- ETH Price Prediction: ETH Slumps Continue Amid the Crypto Market Downtrend

- 5 Best Memecoins Set to Explode in 2023

- SBF Gets A Test Of Life In The 2000s With Internetless Phone

Comments

Post a Comment