Chainalysis: Crypto Scam Revenue Dropped 46% in 2022

Revenue from cryptocurrency scams dropped 46% in 2022, according to blockchain data analytics firm Chainalysis. “We attribute most of this decline to market conditions, as scam performance tends to worsen when cryptocurrency prices are in decline,” the firm explained.

‘Crypto Scam Revenue Fell Significantly in 2022’

Blockchain data analytics firm Chainalysis published its 2023 Crypto Crime Report last week with a section on crypto scams. “Crypto scam revenue dropped 46% in 2022,” the 109-page report reads, elaborating:

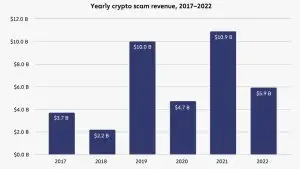

Crypto scam revenue fell significantly in 2022, from $10.9 billion the year prior to just $5.9 billion.

Chainalysis tracks several types of crypto scams, including giveaway scams, impersonation scams, investment scams, non-fungible token (NFT) scams, and romance scams.

Noting its numbers are “a lower-bound estimate,” the blockchain analytics firm explained that “estimates of the true amount lost to fraudsters will grow as we identify more addresses associated with scams.” The firm specifically mentioned “pig butchering” scams which have become alarmingly popular. The Federal Bureau of Investigation (FBI) has warned about this type of crypto scam many times. Last November, U.S. authorities seized seven domains used by pig butchering scammers.

Regarding the decline in crypto scam revenue, Chainalysis detailed:

We attribute most of this decline to market conditions, as scam performance tends to worsen when cryptocurrency prices are in decline.

“Cryptocurrency scam revenue began the year trending upwards, but plummeted in early May — the same time the bear market set in following the collapse of Terra Luna — and then declined steadily throughout the rest of the year,” Chainalysis described.

While noting that “some types of scams see revenue changes increase as crypto asset prices decrease,” the blockchain analytics firm pointed out: “Scam revenue throughout the year tracks almost perfectly with bitcoin’s price, consistently maintaining a three-week lag between price moves and changes in revenue.”

Comments

Post a Comment